Office of the Nominal Defendant of the ACT

Transmittal Certificate

Compliance Statement

The 2017-18 Office of the Nominal Defendant Annual Report must comply with the 2017 Annual Report Directions (the Directions). The Directions are found at the ACT Legislation Register: http://www.legislation.act.gov.au/ni/2017-280/notification.asp.

The Compliance Statement indicates the subsections, under the five parts of the Directions that are applicable to the Office of the Nominal Defendant of the ACT (the Fund) and the location of information that satisfies these requirements:

Part 1 Directions Overview

The requirements under Part 1 of the Directions relate to the purpose, timing and distribution, and records keeping of annual reports. The 2017-18 Office of the Nominal Defendant Annual Report complies with all subsections of Part 1 under the Directions.

In compliance with Section 13 Feedback, Part 1 of the Directions, contact details for the Fund are provided within the 2017-18 Office of the Nominal Defendant Annual Report to provide readers with the opportunity to provide feedback.

Part 2 Agency Annual Report Requirements

The requirements within Part 2 of the Directions are mandatory for all directorates and public sector bodies and the Fund complies with all subsections. The information that satisfies the requirements of Part 2 is found in the 2017-18 Office of the Nominal Defendant Annual Report as follows:

- A. Transmittal Certificate, see page 355;

- B. Organisational Overview and Performance, inclusive of all subsections, see pages 357-361; and

- C. Financial Management Reporting, inclusive of all subsections, is contained within the CMTEDD Annual Report.

Part 3 Reporting by Exception

The Fund has nil information to report by exception under Part 3 of the Directions for the 2017-18 reporting period.

Part 4 Directorate and Public Sector Body Specific Annual Report Requirements

Part 4 of the 2017 Directions is not applicable to the Fund.

Part 5 Whole of Government Annual Reporting

All sections of Part 5 of the Directions apply to the Fund. Consistent with the Directions, the information satisfying these requirements is reported in the one place for all ACTPS Directorates, as follows:

- N. Community Engagement and Support, see the annual report of the Chief Minister, Treasury and Economic Development Directorate;

- O. Justice and Community Safety, including all subsections O.1 – O.4, see the annual report of the Justice and Community Safety Directorate;

- P. Public Sector Standards and Workforce Profile, including all subsections P.1 – P.3, see the annual State of the Service Report; and

- Q. Territory Records see the annual report of the Chief Minister, Treasury and Economic Development Directorate.

ACTPS Directorate annual reports are found at the following web address: http://www.cmd.act.gov.au/open_government/report/annual_reports.

As required by Australian Auditing Standards, the ACT Audit Office checks financial statements included in annual reports (and information accompanying financial statements) for consistency with previously audited financial statements. This includes checking the consistency of statements of performance with those statements previously reviewed (where a statement of performance is required by legislation).

Organisational Overview and Performance

B.1 Organisation Overview

The ACT Insurance Authority is the Office of the Nominal Defendant of the ACT as defined under Section 13 of the Road Transport (Third Party Insurance) Act 2008.

The objectives of the Fund are to:

- provide a safety net mechanism to meet the costs of third party personal injury claims made by injured parties where:

- the vehicle involved does not have a compulsory third party insurance policy; or

- the injured person is unable to identify the driver and vehicle at fault.

- ensure that persons, who are injured in the circumstances listed above, receive the same entitlements as an injured person would receive where the vehicle did have CTP insurance;

- collect recoveries from uninsured drivers at fault to the sum paid out by the Fund; and

- receipt levies collected from each licensed CTP insurer in the Territory as well as the Commonwealth and ACT Governments.

Claims are managed within the auspices of the Road Transport (Third Party) Insurance Act 2008, and the Fund meets the cost of all legislated entitlements for injured people including, rehabilitation costs, medical expenses, and lump sum settlements.

B.2 Performance Analysis

Revenue

Total income recognised by the Fund during the year amounted to $8.05 million.

The CTP regulator imposes a levy on licensed insurers and recognised self-insurers to meet the cost of nominal defendant claims in accordance with the Road Transport (Third Party Insurance) Act 2008.

The funds required to meet the cost of nominal defendant claims is apportioned among the insurers having regard to the amount of third party premium income they receive. Funds are transferred to the Fund on a quarterly basis.

In addition, revenue is received by the Fund from the following sources:

- any penalties or penalty interest imposed under the Act;

- amounts recovered by the Fund;

- Unregistered Vehicle Permits (UVPs) liability contributions to fund cost of nominal defendant claims in relation to unregistered vehicle permits;

- interest accruing from the investments; and

- unregistered vehicle fines liability contributions to assist in the funding of the cost of nominal defendant claims.

The following table details funds received as other revenue during the period totalling $1.08 million.

Table 1: Other revenue

Source | Amount |

|---|---|

Unregistered Vehicle Permits | $515,967 |

Unregistered Vehicle Fines | $410,875 |

Insured Recoveries | $78,973 |

Uninsured owner’s & driver’s | $70,220 |

Total | $1,076,035 |

Expenses

The total expenses paid by the Fund during the year was $6.34 million.

The total claims expense for the reporting period was $5.8 million.

Equity

The Fund had total assets of $28.57 million and liabilities of $28.38 million.

As at 30 June 2018 the total equity of the Fund was $0.19 million.

Claims

During the reporting period the Fund received 53 new claims.

There are 146 open claims remaining as at 30 June 2018 with a combined total provision for outstanding claims of $28.1 million.

Of the 146 open claims, unidentified vehicles account for 36%, unregistered and uninsured vehicles for 59% and 5% are related to unregistered vehicle permits.

Debtor Recoveries

There are currently 48 ‘recovery only’ claim files open. These files are claims that have either settled or been finalised and the Fund is pursuing recovery from unregistered vehicle owners and the drivers of unregistered vehicles responsible for the accident.

Where the Fund has made payments on a claim involving an uninsured motor vehicle, attempts are made to recover the cost of those payments from the owner or driver concerned.

Recovery prospects are poor in the majority of matters as often it is difficult to identify or locate the driver/owner and when located, generally they do not have the capacity to repay any/all of the costs incurred.

The Office of the Nominal Defendant of the ACT financial statements are reported in Volume 2 of the 2017-18 CMTEDD Annual Report.

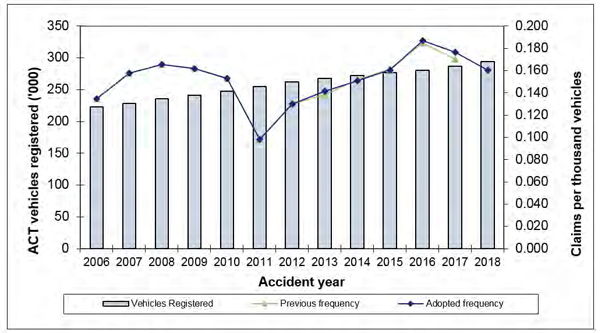

Claims Frequency and Vehicle Registrations

The Australian Capital Territory has 293,768 registered vehicles.

During the reporting period there were approximately 0.16 claims per 1,000 vehicles registered.

A comparison between the number of vehicles registered and the number of claims made to the Fund is shown in the following chart:

Figure 1. Claim frequency and vehicle registrations

Source: Nominal Defendant Liability Valuation Report as at 30 June 2018 produced by KPMG Actuarial.

Note:

- The vehicle registrations for 2018 are sourced from Road User Services ACT, and other years from previous actuarial reports.

- Claim frequency refers to number of road incidents giving rise to a claim, whether one or more claimants. The measure is expressed per thousand vehicles registered.

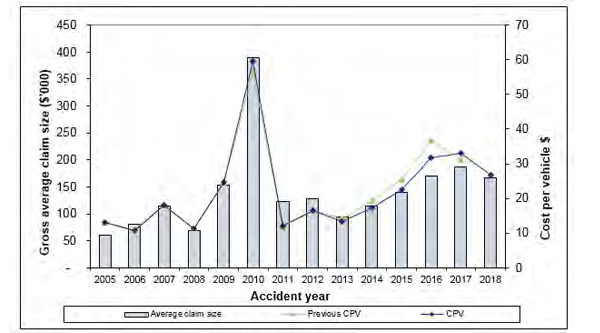

Average claims size and cost per policy

A comparison between the average size of a claim and the cost of a CTP policy is shown in the following table. The average claim size in the period was $0.167 million while the average CTP Claim per policy cost was $26.73.

Figure 2. Average claim size and cost per policy by accident year (inflated and undiscounted)

Source: Nominal Defendant Liability Valuation Report as at 30 June 2018 produced by KPMG Actuarial.

Note:

- Average claim size and Cost Per Policy (CPP) are in expected payment date values, but without allowance for time value of money (i.e. present value discounting), and are gross of all recoveries.

- The historical data component is sourced from previous actuarial reports.

B.3 Scrutiny

There were no inquiries or reviews from the ACT Auditor-General, the ACT Ombudsman, or any Legislative Assembly Committees in 2017-18. The only scrutiny from the Auditor-General during the reporting period was for the audit of the 2016-17 Financial Statements.

B.4 Risk Management

The Fund is part of the ACT Insurance Authority. As such, it is covered in the ACT Insurance Authority’s risk management arrangements.

B.5 Internal Audit

The Fund is part of the ACT Insurance Authority. As such, the internal audit functions were provided by the Chief Minister, Treasury and Economic Development Directorate Audit and Risk Committee (the Committee). The Committee’s functions are governed by the Audit Committee Charter.

During 2017-18 the committee reviewed the findings of the Internal Audit of Default Insurance Fund and Nominal Defendant Fund conducted by the private audit firm, Protiviti during 2016-17.

B.6 Fraud Prevention

The functions of the Fund are supported by the ACT Insurance Authority who adhere to its own Fraud and Corruption Prevention Plan.

B.7 Workplace Health and Safety

The Fund does not directly employ personnel. The functions of the Fund are supported by the ACT Insurance Authority who adhere to the provisions outlined in the Work Safety Act 2011.

B.8 Human Resource Management

The Fund does not directly employ personnel. The functions of the Fund are supported by the ACT Insurance Authority.

The ACT Insurance Authority’s Annual Report section on Human Resources Management applies to the Fund.

B.9 Ecologically Sustainable Development

The ACT Insurance Authority’s Annual Report section on Ecologically Sustainable Development applies to the Fund.

Financial Management Reporting

C.2 Financial Statements

The Fund’s financial statements are reported in Volume 2 of the 2017-18 Chief Minister, Treasury and Economic Development Directorate Annual Report.

C.3 Capital Works

The Fund did not have any capital works expenditure during the reporting period.

C.4 Asset Management

The Fund has no physical or intangible assets under management. The Fund has some capacity to invest funds over the medium and long term.

C.5 Government Contracting

The Fund engages consultants to perform specialised functions of actuarial services and legal advice.

The procurement selection and management processes for all contractors including consultants complied with the Government Procurement Act 2001 and the Government Procurement Regulation 2007.

Procurement processes above $25,000 have been reviewed by Goods and Services Procurement, and if necessary, by the Government Procurement Board consistent with the provisions of the Government Procurement Regulation 2007. The Authority has complied with all employee and industrial relations obligations in relation to contractors employed.

Table 2: Contracts with a value of $25,000 or more are listed in the table below

Contract Title | Procurement Methodology | Contractor Name | Contract Amount | Execution Date | Expiry/ |

|---|---|---|---|---|---|

Actuarial Services to the Office of the Nominal Defendant of the ACT | Quotations | KPMG Actuarial Pty Ltd | $150,000 | December 2015 | December |

Further information may be obtained from

John Fletcher

General Manager

ACT Insurance Authority

+61 2 6207 0268

john.fletcher@act.gov.au